car lease tax write off

The vehicle excise tax deduction is a federal item and is specifically reported to the IRS on Form 1040 Schedule A Line 7 please see. Parking fees and tolls are also deducible regardless.

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

May 31 2019 805 PM.

. Say your business use is 60 percent and you are making a monthly payment of 400 on it. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. You may be paying taxes on the car twice -- once if the lessor must pay a sales tax to buy the car for you and once if part of.

The expenses will include tires gas tune-ups insurance fee etc. The IRS mileage rate changes slightly every year. The lease payment is 400 per month or 4800 per year.

So if I lease a car with monthly lease payments being around 450 which yearly accumulates to around 5400 how much of that would I be able to write off on taxes since Im a real estate agent in Canada. The deduction is based on the portion of mileage used for business. You can write off work-related expenses by either deducting the standard mileage rate or by deducting actual expenses.

State law allows tax exemptions for vehicles owned by certain disabled people and veterans former prisoners of war and their surviving spouses and charitable organizations. Once a contract is signed it is considered legally binding. A leased car driven 9000 miles for business equates to a 5175 deduction 12000 miles 3000 personal and commuting miles 0575 IRS mileage rate.

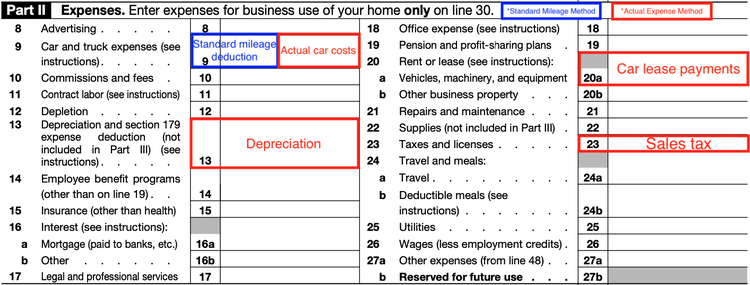

Leased car payments can be a personal or a business lease car depreciation does not apply to leased vehicles only works for new cars The actual cost method relies on the percentage of the business portion of the car usage. On top of that if theres an upfront cost or. You have a very.

If you dont make your payment within 30 days of the date the City issued. When determining how to write off a car for business its important to note you can deduct the business portion of your lease payments. The rate in 2019 was 058 and it sits at 0575 in 2020.

Or should I put money down and finance a vehicle with monthly payments. If you lease a new vehicle for 400 a month and you use it 50 of the time for business you may deduct a total of 2400 200 x 12 months. Delivery type vehicles such as classic cargo vans or box trucks with no passenger.

Heavy SUVs Vans and Pickups that are more than 50 business-use and exceed 6000 lbs. Lets continue with the previous example. Look for the total miles percentage of the leased car used during the business not including commuting.

If a taxpayer uses the car for both business and personal purposes the expenses must be split. Here are the qualified vehicles that can get a Section 179 Tax Write-Off. Unless you buy the car at the end of the lease you will never have any equity in a car and may fall into the pattern of interminable monthly leasing payments without ever owning any vehicle.

Therefore the income tax deduction is 327460 calculated as 4800 - 122 x 70. Tax write off on a car lease. Gross vehicle weight can qualify for at least partial Section 179 deduction and bonus depreciation.

Deductible expenses include your annual lease payment total license fees gas maintenance costs insurance tires parking fees and tolls. Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. Youre waiving the ability to write off any more leased car expenses for the rest of the lease.

However you should still review all the terms of the vehicle sales contract or other written agreement to see if there is any part of it that would allow you to cancel the contract after it has been signed. You can write off 240 for. You wont see a special place to enter the vehicle excise tax deduction on your Massachusetts state return either in the TurboTax software or elsewhere because it simply does not exist.

In this car lease write-off method you deduct the actual costs of the car you leased. Would leasing be the best option. Its GVWR meets the criteria for the accelerated vehicle tax deduction with a weight of 6834 to 7077 lbs.

Not bad at all. Business owners and self-employed individuals. Car depreciation is reserved for vehicles you own not lease.

Using Appendix A the applicable inclusion amount is 122. Business use of the car is 70 percent. Certain leased cars qualify for a section 179 vehicle deduction potentially allowing you to take a first-year deduction that exceeds your actual lease costs for the year.

For 2011 taxes the car is in the third year of its lease. If accelerated this car can give you a tax deduction of 92000 in the first year. You cannot deduct all the cost of the leased car if you use it for personal trips.

According to the IRS you can include gas oil repairs tires insurance registration fees licenses and lease payments for the portion of miles that were business-related.

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is It Better To Buy Or Lease A Car Taxact Blog

How To Take A Tax Deduction For The Business Use Of Your Car

Is It Better To Buy Or Lease A Car Taxact Blog

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Should I Buy Or Lease My New Business Vehicle 2022 Turbotax Canada Tips

Leasing Vs Buying A Car Tax Deduction On Your Vehicle How To Calculate A Car Payment Youtube

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High Mileage Lease Right For Me

Writing Off A Car Ultimate Guide To Vehicle Expenses

Vehicle Tax Deductions How To Write Off Car And Truck Expenses

How To Write Off A Car Lease For Your Business In 2022

What Happens When You Lease A Car Credit Com

How To Deduct Car Lease Payments In Canada

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)